SAVE Repayment Plan Offers Lower Monthly Loan Payments for those seeking help with student loans.

Student loan interest resumed on September 1, 2023, and student loan payments will be due starting in October. A new income-driven repayment plan is now available to eligible borrowers to repay their federal student loans. The Saving on a Valuable Education (SAVE) plan may result in reduced monthly payments and lower total loan repayment costs.

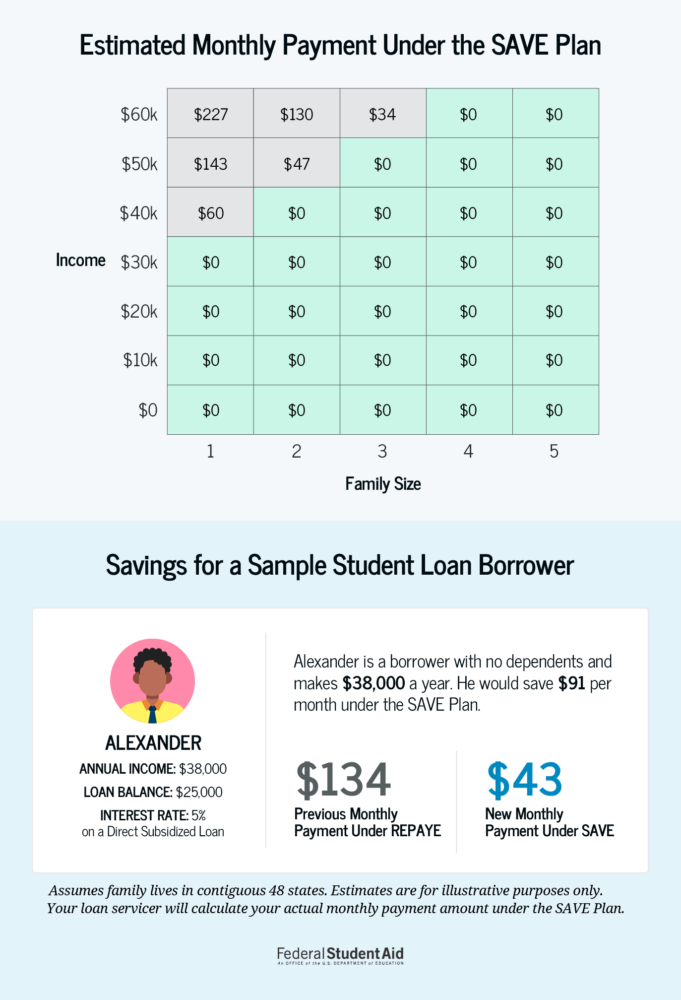

The SAVE student loan repayment plan provides the lowest monthly payments of any income-driven repayment (IDR) plan. The plan calculates monthly payments based on income and family size and is available to nearly all student borrowers.

The SAVE Plan replaces the Revised Pay As You Earn (REPAYE) Plan. Borrowers on the REPAYE Plan will automatically get the benefits of the new SAVE Plan.

The benefits of the SAVE plan will be particularly critical for low- and middle-income borrowers, community college students, and borrowers who work in public service. Overall, the Department estimates that the plan will have the following effects for future cohorts of borrowers compared to the existing REPAYE plan:

- Borrowers will see their total payments per dollar borrowed fall by 40%. Borrowers with the lowest projected lifetime earnings will see payments per dollar borrowed fall by 83%, while those at the top would only see a 5% reduction.

- A typical graduate of a four-year public university will save nearly $2,000 a year.

- A first-year teacher with a bachelor’s degree will see a two-third reduction in total payments, saving more than $17,000, while pursuing Public Service Loan Forgiveness.

- 85% of community college borrowers will be debt-free within ten years.

- On average, Black, Hispanic, American Indian, and Alaska Native borrowers will see their total lifetime payments per dollar borrowed cut in half.

Frequently Asked Questions

What Borrowers Need to Know

The SAVE Plan includes multiple new benefits for borrowers. The changes below will go into effect this summer. Additional benefits will go into effect in 2024.

| New Plan Change | What This Means |

| The SAVE Plan increases the income exemption from 150% to 225% of the poverty line. | The new plan can significantly decrease the monthly payment amount compared to all other income-driven repayment plans. The monthly payment amount is based on discretionary income—the difference between adjusted gross income (AGI) and 225% of the U.S. Department of Health and Human Services Poverty Guideline amount for family size. That means someone will not owe loan payments if they are a single borrower earning $32,800 or less or a family of four earning $67,500 or less (amounts are higher in Alaska and Hawaii). Borrowers earning more than these amounts will save at least $1,000 per year compared to the current income-driven repayment plans. |

| After a scheduled payment is made under the SAVE Plan, the plan eliminates 100% of the remaining interest for subsidized and unsubsidized loans. | If a borrower makes their monthly payment, their loan balance won’t grow due to unpaid interest. For example, If $50 in interest accumulates each month and a borrower has a $30 payment, the remaining $20 would not be charged. |

| The SAVE Plan excludes spousal income for borrowers who are married and file separately. | This change removes the need for a spouse to cosign an IDR application. |

When can borrowers apply for the SAVE Plan?

A beta version of the updated IDR application is now available and includes the option to enroll in the new SAVE Plan. The application may be available on and off during this beta testing period. If the application is not available, try again later.

The Department of Education now accepts applications to help refine processes before the official launch. If borrowers submit an IDR application now, it will be processed and will not need to be resubmitted. Applicants will receive an email confirmation after applying.

If a borrower has already enrolled in the REPAYE Plan or recently applied, they will automatically be put on the SAVE Plan. There is no need to reapply or request to change a plan. Learn how to check which plan you’re on.

How do borrowers apply for the SAVE Plan?

Use the IDR application to apply for the SAVE Plan now. Applicants can select the option for their loan servicer to place them on the lowest monthly payment plan (this will usually be SAVE).

Related Article: Still in school? Lessen student loans with these scholarships.

What if a borrower is already on an Income-Driven Repayment plan?

If a borrower is already on a student loan income-based repayment plan, they can check to see which plan. Log in to StudentAid.gov, go to the My Aid page, scroll down, and view loans. Each loan will list a repayment plan.

If borrowers see they are in the REPAYE Plan, they will automatically be enrolled in the SAVE Plan later this summer. If a borrower is on a different repayment plan, they will need to switch to receive the benefits of the SAVE Plan. Borrowers without a StudentAid.gov account can create an account.

How much will a borrower pay each month with the SAVE repayment plan?

The SAVE Plan calculates monthly payment amounts based on income and family size. Starting this summer, if someone makes $32,800 a year or less (roughly 15 dollars an hour), their monthly payment will be $0. If someone makes more than that, they will save at least $1,000 a year compared to other IDR plans.

Will the SAVE repayment plan lower monthly payments?

Trying to find out how to reduce federal student loan payments? The new student loan income-based repayment plan can significantly decrease your monthly payment amount.

If a borrower applies for the SAVE repayment plan this summer, will their application be processed before they start making payments in October?

Yes. If a borrower applies for an IDR plan (such as the SAVE Plan) this summer, their application will be processed in time for the first payment due date. It may take the servicer a few weeks to process a request because they must obtain documentation of the applicant’s income and family size.

What are the SAVE Plan benefits going into effect next year?

The SAVE Plan includes additional benefits that will go into effect in July 2024. These other benefits will likely reduce payments further and make it easier to manage repayment. The benefits include the following:

- Payments on undergraduate loans will be cut in half (reduced from 10% to 5% of income above 225% of the poverty line). Borrowers with undergraduate and graduate loans will pay a weighted average of between 5% and 10% of their income based on the original principal balances of their loans.

- Borrowers with original principal balances of $12,000 or less will receive forgiveness of any remaining balance after making ten years of payments, with the maximum repayment period before forgiveness rising by one year for every additional $1,000 borrowed. For example, if someone’s original principal balance is $14,000, they will see forgiveness after 12 years. Payments made previously (before 2024) and those made in the future will count toward these maximum forgiveness timeframes.

- Borrowers who consolidate will not lose progress toward forgiveness. They will receive credit for a weighted average of payments that count toward forgiveness based upon the principal balance of the loans being consolidated.

- Borrowers will automatically receive credit toward forgiveness for specific periods of deferment and forbearance.

- Borrowers will be allowed to make additional “catch-up” payments to get credit for all other periods of deferment or forbearance.

- Borrowers who are 75 days late will be automatically enrolled in IDR if they have agreed to allow the Department of Education to access their tax information securely.

Related Article: Still in high school? Learn how to apply for federal student loans.

Not sure where to start? Try these federal student loan repayment tips from financial professional Al Riddick. Al is the founder and president of Game Time Budgeting, an award-winning financial fitness firm that helps employees develop the proper mindset, behaviors, and systems so they can save more, reduce debt, and live a better life.

Information provided by The Department of Education

The Voice of Black Cincinnati is a media company designed to educate, recognize, and create opportunities for African Americans. Want to find local news, events, job postings, scholarships, and a database of local Black-owned businesses? Visit our homepage, explore other articles, subscribe to our newsletter, like our Facebook page, join our Facebook group, and text VOBC to 513-270-3880.

Images provided by AdobeStock